On Friday afternoon, July 30th, CARB posted the first quarter 2021 data for the LCFS program. The 1Q2021 report gives us insight into the credit bank situation for a full year following COVID-19 stay-at-home orders. In today’s flash report, we offer a quick look at the first quarter data. Our comprehensive analysis will be published in Stillwater’s Quarterly LCFS Newsletter which will be available to subscribers on August 10th.

The first quarter data shows a draw in the credit bank of 259,301 metric tons (MT) of credits, nearly offsetting the 4Q2020 net credit of 373,724 MT. This first-quarter draw in credits is about half the size of the 1Q2020 net deficit of more than 470,000 MT. With the 1Q2021 net deficit, the credit bank now stands at 7.6 million MT.

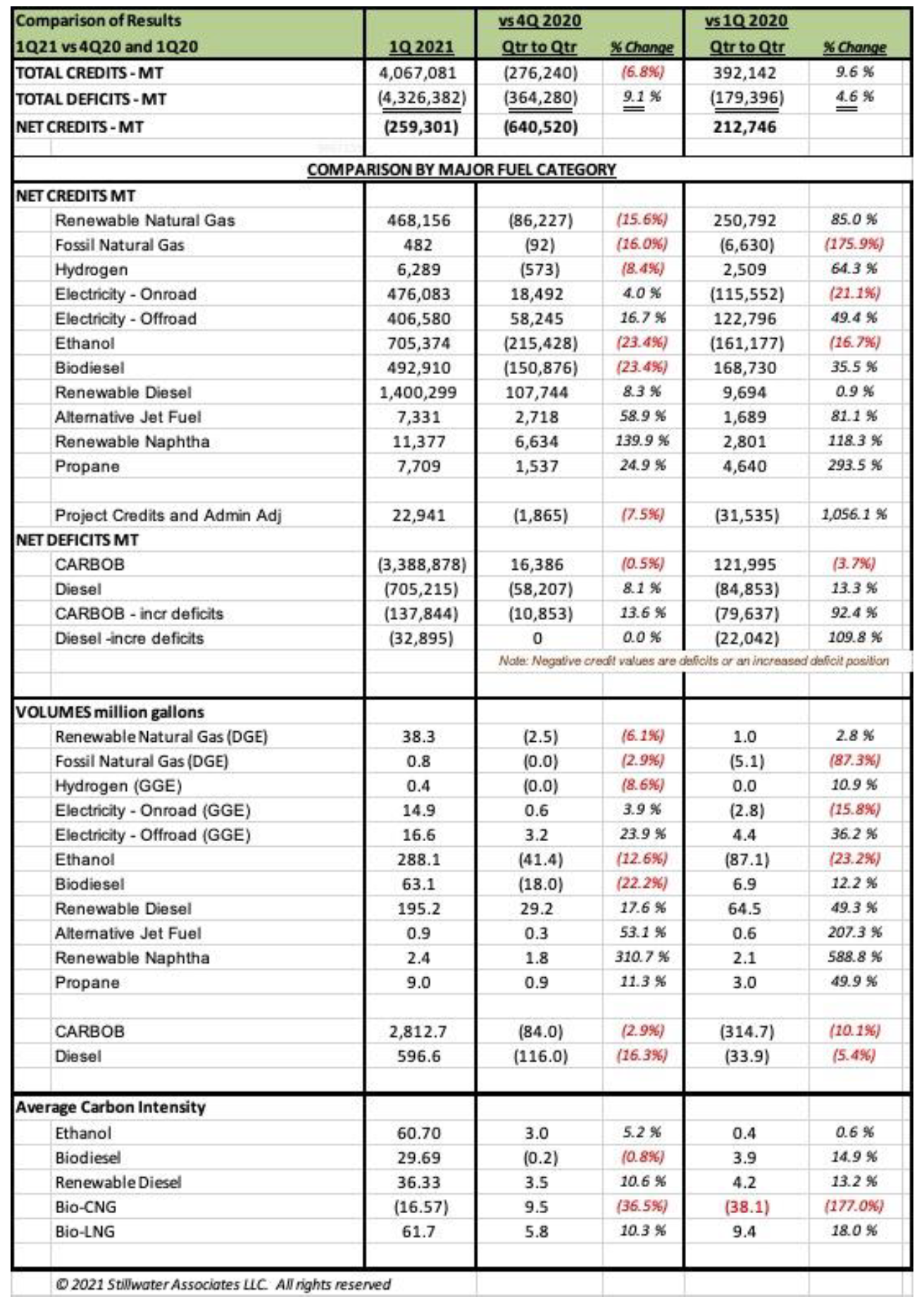

The table below summarizes the quarter and compares it to the prior quarter and same quarter last year.

A quick look at this data shows a few trends of interest. RD volumes rose by nearly 18% from the previous quarter and 49.3% from 1Q2020. Off-road electricity credits rose 16.7% and volumes rose nearly 24% from 4Q2020.

Ethanol credits dropped by a whopping 23.4% and ethanol volumes dropped by nearly 13% from 4Q2020. Meanwhile, CARBOB volumes declined by just 2.9% compared to 4Q2020 but were off 10% compared to 1Q2021. Typically, CARBOB and ethanol track each other to make the E10 requirement. As such, this disparate decline between ethanol and CARBOB likely marks a backlog of ethanol inventory being drawn down. Biodiesel also dropped, generating 23.4% fewer credits than the previous quarter and dropping in volume by 22%. ULSD volumes also dropped by 16% from 4Q2020.

We will provide an in-depth analysis of this data in our upcoming quarterly newsletter, published on August 10, 2021.

Stillwater’s LCFS team also offers Bespoke LCFS Credit Balance and Credit Price Outlooks!

Stillwater’s LCFS credit price outlook includes historical LCFS credit balances and prices as a foundation for understanding forward-looking curves. We also present three credit balance and credit price curves through 2031 – our “most likely” curves for both credit balances and credit prices in addition to high and low curves which serve to bound the outlook. Our price projections are based on our analysis of the supply of low-CI fuels in California, the demand for fossil gasoline and diesel, our outlook on carbon intensities of each fuel pool, the evolution of the vehicle fleet, and the ongoing development of the LCFS regulation. Overlaying the numerical analysis is Stillwater’s deep understanding of regulatory actions and the evolution in California, the commercial fuels market, fuels logistics, market structure and players.

Stillwater’s Bespoke, Ten-Year LCFS Credit Balance and Credit Price Outlook includes:

- A table of our annual projected values for LCFS credits.

- Graphs of the supply, demand, and carbon intensity trends that inform our view of the LCFS credit price curve.

- Commentary around CARB’s historic and expected actions to regulate LCFS credit pricing.

- Qualitative descriptions of all key variables and how the data and factors mentioned above influence the forecast.

Stillwater can also run additional scenario investigations utilizing the above-described proprietary model. In this way, Stillwater can evaluate your assumptions and produce unique credit balance and price curves based on these assumptions.

Contact us to learn more about Stillwater’s Bespoke LCFS Outlook!