This afternoon, CARB posted the fourth quarter 2020 data for the LCFS program. The 4Q2020 report gives us insight into the credit bank situation for the nine months following COVID-19 stay-at-home orders. In today’s flash report, we offer a quick look at the fourth quarter data. Our comprehensive analysis will be published in Stillwater’s Quarterly LCFS Newsletter which will be available to subscribers on May 11th.

The fourth quarter data shows a build in the credit bank of nearly 374,000 metric tons (MT) of credits, building upon the 3Q2020 net credit of 116,000 MT. This fourth-quarter growth is more than twice the size of the 4Q2019 net credit of 160,000 MT. With the 4Q2020 net credit, the credit bank ends 2020 at 8.1 million MT.

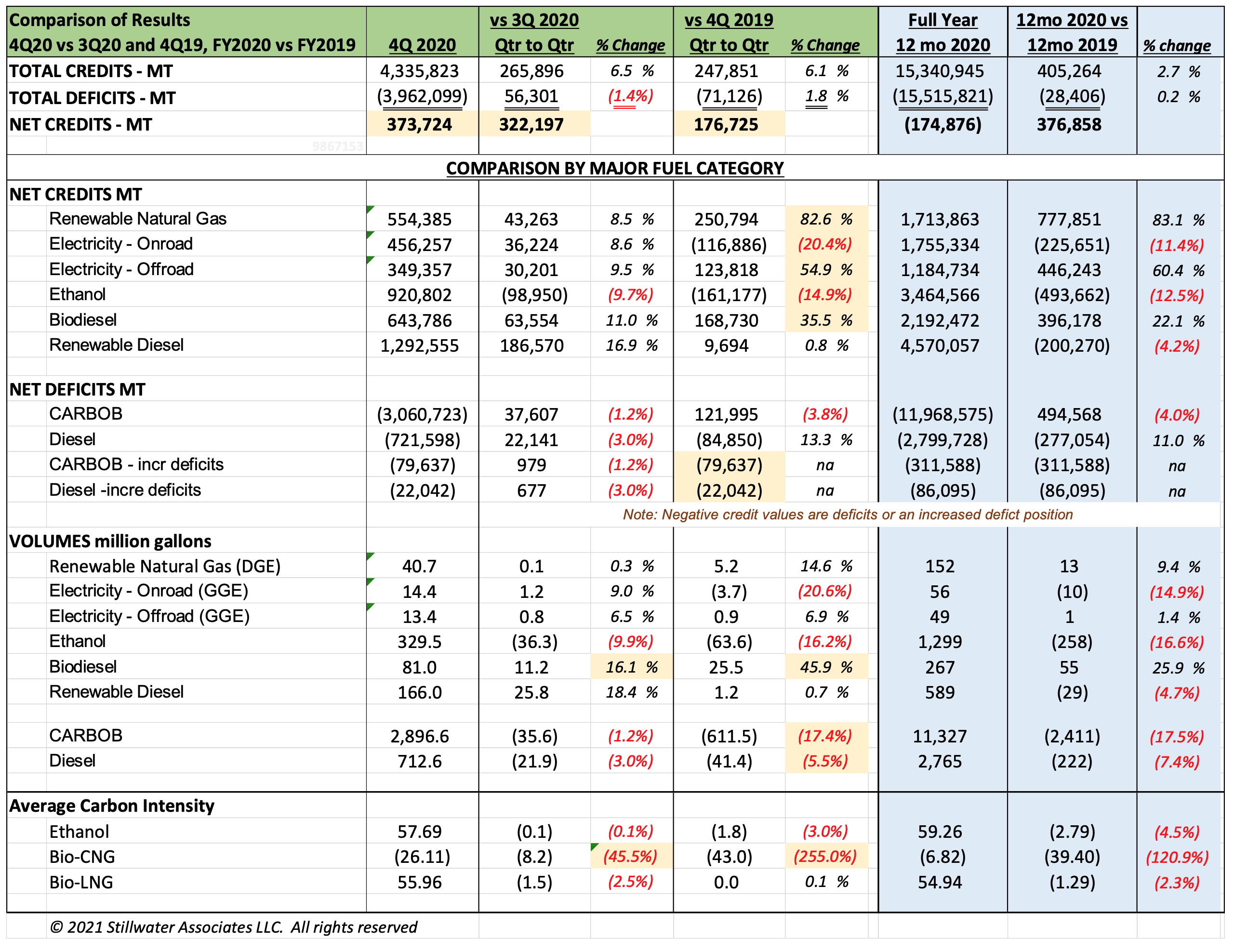

The table below summarizes the quarter and compares it to the prior quarter and same quarter last year.

A quick look at this data shows a few trends of interest. Credits generated from renewable natural gas (RNG) grew 8.5% compared to 3Q2020 and nearly 83% compared to the fourth quarter of 2019. Most of this growth in credit generation from RNG was due to improved average CI for the RNG pool as there is very little difference in the volume. Notably, the average CI of bio-CNG decreased by 8.2 gCO2e/MJ compared to 3Q2020 and 43 gCO2e/MJ compared to the fourth quarter of 2019. Also notable, CARBOB volumes remain well below pre-pandemic levels, with 4Q2020 logging 17.4% less than the fourth quarter of 2019. Finally, the incremental crude provision contributed over 498,000 MT of deficits in 2020. By contrast, there were no incremental crude deficits in 2019.

We will provide an in-depth analysis of this data in our upcoming quarterly newsletter, published on May 11, 2021. Access to Stillwater’s LCFS Newsletter is only available to subscribers. For more detailed information on LCFS data trends and analysis, be sure to subscribe! Your first two weeks are free, so subscribe today to receive our Quarterly Analysis in your trial period.