A month ago, WTI crude oil price closed at $52.10 per barrel, the Dow Jones closed at 29,232 and the S&P at 3,370. Yesterday, these values were $25.22, 20,087 and 2,409 respectively. Clearly, the past month has been unprecedented for both the crude oil and financial markets. Socially, almost everyone in the U.S. has had their everyday lives disrupted by the COVID-19 pandemic as the terms “social distancing,” “self-isolation,” and “community shelter in place” have entered our common lexicon. After the experience of the past month, we can be certain that the next few weeks and months will be unpredictable and volatile.

What does this mean for the LCFS?

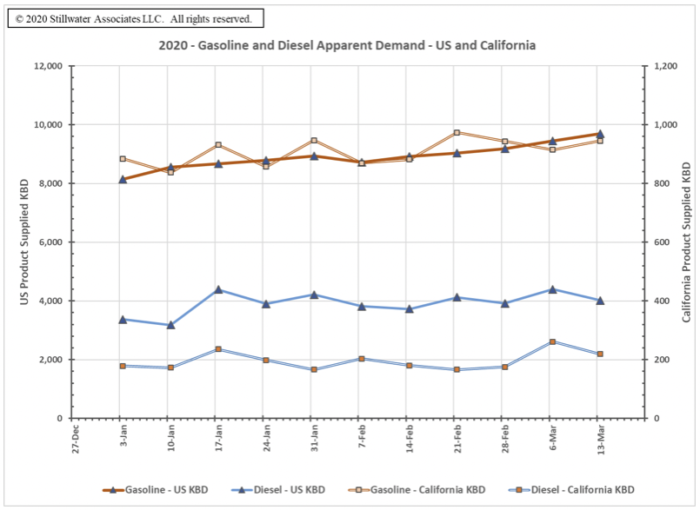

The demand for California’s LCFS credits, Oregon’s CFP credits, and federal RFS RINs are driven by the volume of petroleum-based gasoline and diesel fuel supplied to each program’s regulated market. Therefore, the credits demand driver is gasoline and diesel demand. Interestingly, the weekly U.S. Energy Information Administration (EIA) and California Energy Commission (CEC) data available to-date has not shown a decline in gasoline demand through the week ending March 13th as shown in Figure 1.

Figure 1. 2020 Gasoline and Diesel Apparent Demand – U.S. and California

Although the decline in demand we had anticipated due to the COVID-19 pandemic is not yet reflected in the data, many drastic virus-containment measures that would decrease fuels demand have been implemented in recent days. Recent anecdotal evidence of greatly reduced traffic, restrictions on retail and restaurants, and people isolating at home indicates that demand destruction is all but certain. Early this week, OPIS reported that the U.S. could see 40-50% gasoline demand destruction at the trough. Considering the fact that the 2008 financial meltdown caused demand destruction of only 3% (as discussed in Stillwater’s February 2020 Monthly LCFS Newsletter), a 40%-50% decline is dramatic. Bottom line: All signs point to lower demand at least in the near term, but the magnitude of demand reduction during this virus containment period and 2020 in total is anyone’s guess.

For the LCFS program, the petroleum component of gasoline (CARBOB) and the petroleum component of diesel (ULSD) are the deficit generators. As such, the volume of demand for these petroleum-based fuels is the basis of demand for LCFS credits. The LCFS credit demand (i.e. deficit generation) should be proportional to transport fuels demand destruction. However, the credit demand reduction by ULSD would be proportionally greater than the fuel demand destruction if renewable diesel (RD), and biodiesel (BD) – the primary credit generators in the diesel pool – volumes do not reduce similarly.

On the credit supply side, alternate fuels such as electricity, CNG, LNG, and hydrogen may see some volume decline similar to and for the same reasons as gasoline and diesel. The largest impact may come if RD and BD volumes decline. We have seen the economics for these fuels change drastically in a short time as feedstock costs have become volatile, the base commodity (gasoline and diesel) prices have declined sharply, and the cost of shipping has increased sharply as tankers are used to store the growing surplus of crude oil. In spite of these changes, RD and BD volumes (which represented 21.4% of the liquid diesel pool) will probably be maintained since LCFS credits provide superior economics for those fuels in California.

Bottom line: The reduction in the deficit side of the LCFS credit equation should be greater than the fuels demand reduction. On the credit supply side, there will be some reduction due to the events of the past month, but at this point we expect those declines to be relatively small. All told, we are expecting that reduced demand for traditional fuels will result in a higher net credit balance for the year than we might have expected before the coronavirus outbreak.

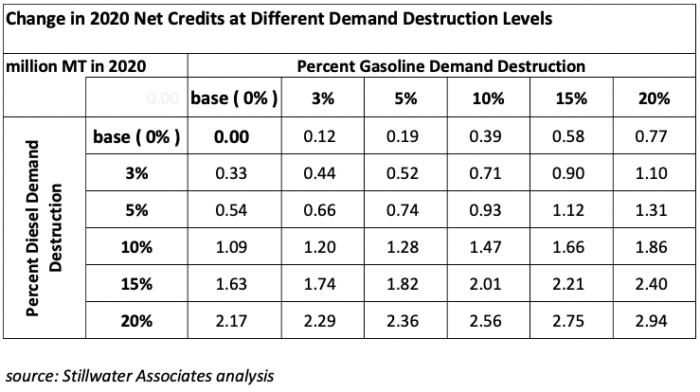

The impact to the LCFS credit supply/demand balance will depend on the magnitude of fuels demand destruction. We have made some rough-cut estimates of the impact on the 2020 net credit balance at different demand destruction assumptions for 2020. These are presented in the table below:

Table 1. Change in 2020 Net Credits at Different CARBOB and ULSD Demand Destruction Levels

Depending on the magnitude of transport fuels demand destruction, 2020 could end with net positive credits compared to a 1.06 million MT net deficit in 2018 and an expected 1.2 million MT net deficit for 2019.

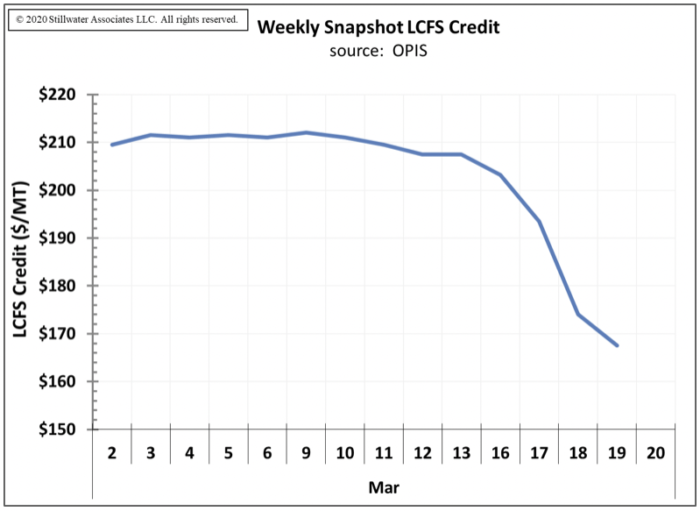

This week, we may have seen evidence of slowing demand for LCFS credits in the credit market. As shown in the figure below, LCFS credit prices have dropped more than 20% from their recent $210/MT level.

Figure 2. LCFS Credit Prices for March 2020

The recent price drop may be due to gasoline and diesel refiners and importers anticipating reduced demand resulting in reduced needs for LCFS credits. Another explanation may be a need for liquidity by entities over a need to maintain their credit bank.

We are continually monitoring this information, and, as warranted, will continue providing our analysis and insight to our subscribers through the LCFS Newsletters and, less regularly, through complimentary Flash Reports.

Stillwater Associates see things others miss, and we stand ready to partner with you. Contact us for personalized, in-depth analysis around GHG policies and downstream fuels markets.