July 29, 2022

On Friday, July 29th, CARB posted the first quarter 2022 data for the LCFS program. In today’s flash report, we offer a quick look at the first quarter data. Our comprehensive analysis will be published in Stillwater’s Quarterly LCFS Newsletter which will be available to subscribers on Thursday, August 11th.

The first quarter data show a net credit of 892,431 metric tons (MT), building on the fourth quarter 2021 net credit of 975,292. Notably, this first-quarter net credit is second only to the 4Q2021 net credit for the highest quarterly credit recorded. The first quarter net credit was 1.15 million MT larger than 1Q2021 which was a deficit of 260,343 MT. Historically, the first quarter of each year has delivered the smallest net credit of any quarter. With the 1Q2022 net credit, the credit bank now stands at 10.35 million MT – breaking 10 million MT for the first time in program history.

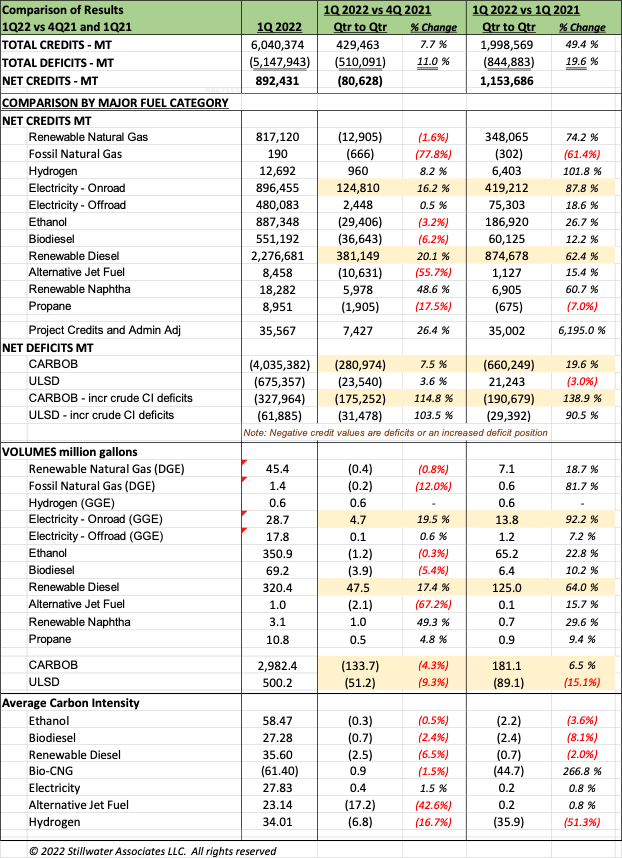

The table below summarizes the quarter and compares it to the prior quarter and same quarter last year.

A quick look at this data shows a few trends of interest. Two major factors contributed to the sizeable net credit: increases in credits for RD and for on-road electricity. Compared to the fourth quarter of 2021, the first quarter 2022 showed a 20% increase in RD credits on a 17.3% volume increase. This increase has been anticipated as additional RD capacity is coming online. For on-road electricity, credits increased 16.2% on a volume increase of 19.5%. Deficits for CARBOB and ULSD increased by 11% as the benchmarks decreased by 1.25% for 2022 and the incremental crude CI deficits more than doubled from 0.41 gCO2e/MJ to 0.91 gCO2e/MJ. Combined, CARBOB and ULSD volume was down 5% from 4Q2021.

We will provide an in-depth analysis of this data in our upcoming quarterly newsletter, to be published on August 11, 2022. Access to Stillwater’s LCFS Newsletter is only available to subscribers. For more detailed information on LCFS data trends and analysis, be sure to subscribe! Your first two weeks are free, so subscribe today to receive our Quarterly Analysis in your trial period.